U.S. MULTIFAMILY MARKET:

Strategic Patience Beats Short-Term Panic

October 2024

The multifamily housing sector, like any real estate market, will inevitably experience periods of expansion and contraction. However, investors who take a long-term view and resist reacting to short-term market fluctuations are better positioned to recognize opportunities. With the right perspective, investors can navigate these cycles and potentially capitalize on the forces that may drive multifamily demand in the years ahead.

In the short term, there’s no denying that the multifamily sector has felt some pressure. Elevated interest rates have driven up debt-servicing costs, and rent growth has temporarily slowed, as highlighted in Yardi’s June 2024 Multifamily Market Report. Despite these transitory challenges inciting a spate of alarmist headlines, industry sources such as Green Street’s U.S. Apartment Outlook suggest that the multifamily industry’s core fundamentals remain strong, underpinned by a simple truth: housing is an essential, enduring need, and the market simply doesn’t have enough of it.

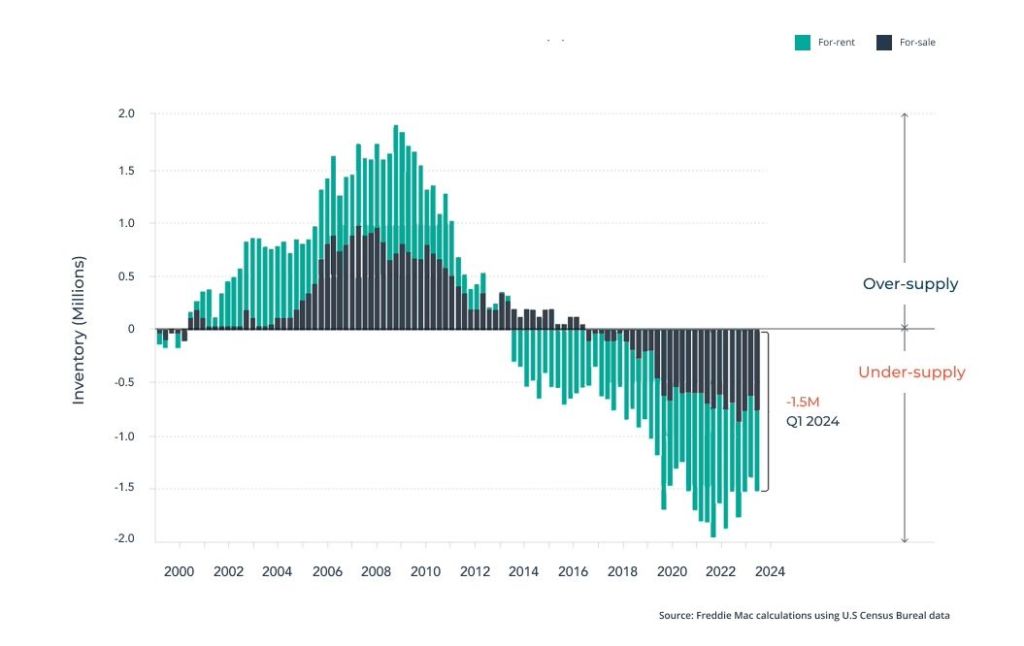

THE U.S. IS 1.5 MILLION HOMES UNDERSUPPLIED

Total For-Sale and For-Rent Vacant Housing

(Click image to view larger)

Image Source: Freddie Mac. “Economic Growth Moderated at the Start of the Year.” Freddie Mac Research, 16 May 2024, www.freddiemac.com/research/forecast/20240516-economic-growth-moderated-start-year.

According to a recent report from Freddie Mac, the country faces a shortfall of at least 1.5 million homes to meet current housing demands. As such, solving the nation’s chronic undersupply and affordability crisis is a central policy point in the U.S. presidential election. As the NY Times notes, “few quick fixes are available for an affordable housing shortfall that has been more than 15 years in the making.” Without meaningful intervention and support for multifamily development, the affordability crisis will only worsen, placing even more pressure on policymakers to ease the path for developers.

MARKET CYCLES ARE A NATURAL PART OF REAL ESTATE

The multifamily sector, like all real estate markets, is cyclical. While interest rate and rent growth fluctuations may present challenges, these factors are part of the market’s natural rebalancing. For example, the high interest rates that have made debt servicing more expensive for property owners have also dampened homebuying activity, keeping more potential homeowners in the rental market. This is a prime example of how the very factors causing short-term pain can simultaneously support long-term stability.

Moreover, the moderation in rent growth observed over the last 12 months is a sign of a market correcting after a period of rapid expansion. According to Apartments.com, the gap between multifamily supply and demand narrowed in Q2 2024, indicating that demand remains strong, particularly for mid-priced properties, even given the amount of supply delivering across the Sunbelt.

DEMOGRAPHIC SHIFTS DRIVING RENTAL DEMAND

One of the most significant drivers of future growth in the multifamily sector is the entry of Generation Z into the rental market. According to a report from the Joint Center for Housing Studies at Harvard University, Gen Z is on track to surpass Millennials as the dominant force in rental demand. This younger cohort, larger in size than Millennials and comparable to Baby Boomers, represents a long-term, viable source of renters.

Gen Z, like Millennials before them, values flexibility and the convenience of modern amenities. Their preferences for smart technology, energy efficiency, and high-speed connectivity make multifamily units, which are increasingly equipped with these features, an attractive option. Additionally, as job mobility remains high among younger generations, renting provides the flexibility they need to relocate for career opportunities. This new wave of renters suggests that multifamily housing could continue to draw steady demand, even as Millennials age into homeownership.

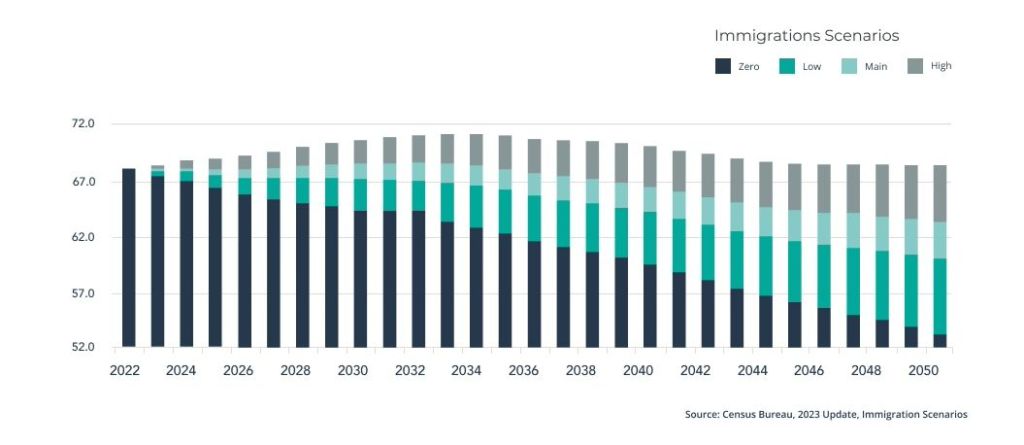

Another key factor shaping the future of multifamily real estate is immigration. Following a temporary dip during the pandemic, migration has resumed, particularly to states with thriving economies across the Sunbelt. Foreign-born households, according to Capital Economics, have a higher propensity to rent, making them a crucial demographic for the multifamily sector. In cities like San Francisco, Providence, and Miami, foreign-born households have contributed significantly to the growth in renter households—sometimes accounting for over 70% of the increase.

U.S. IMMIGRATION FORECASTS

Age 20-34 Cohort (Millions)

(Click image to view larger)

Image Source: Fannie Mae, 2024 Mid-Year Multifamily Market Outlook – Skies Remain Cloudy, August 2024

As policies evolve, the multifamily sector could benefit from a steady influx of new residents seeking rental housing, and investors who plan for these demographic trends may be able to capitalize on sustained demand.

SUPPLY CONSTRAINTS COULD SUPPORT

LONG-TERM STABILITY

Select markets like Austin, Phoenix, and Dallas-Fort Worth, which experienced heavy building activity in 2021, are now grappling with a temporary overhang of units—an uneven narrative that has been disproportionately emphasized in recent headlines. This surge in construction starts occurred just before the capital markets shifted and borrowing costs increased, leaving select regions with more delivering units than immediate demand.

However, a more recent deceleration in new construction—driven by limited access to financing, higher construct costs, and a wide gap between buyer and seller expectations for land pricing—could provide an opportunity for those markets to stabilize and resume healthy rent growth. The National Association of Homebuilders cites tight lending conditions and the high cost of development loans for the decline in housing starts, which were down 21.8% year over year as of June 2024. This reduction in building is expected to further deepen the supply/demand gap heading into 2025 and 2026. According to Costar economists, at the national level, new multifamily deliveries are expected to decline by 58% in 2025.

LONG-TERM RESILIENCE IN THE MULTIFAMILY MARKET

For investors who can see the forest through the trees, this cyclical slowdown in construction activity may present opportunities. Projects that are well-funded and are in the early stages of development have the potential to enter the market at an advantageous time, with less competition from new construction. This strategic timing can improve occupancy rates and stabilize cash flow faster, making these projects a compelling option for investors seeking stable, well-positioned assets.

Housing, after all, is a necessity, and tailwinds—such as the rise of Gen Z renters and continued affordability challenges impeding homeownership—are creating a robust foundation for future multifamily demand.

Market cycles are an inherent and healthy part of the real estate sector, presenting opportunities for those who align with developers experienced in navigating these fluctuations. The key for investors is to partner with firms that have a strong track record of weathering market volatility while maintaining a long-term, strategic perspective. By staying focused on the broader trends and tuning down the noise, investors can position themselves effectively in the multifamily housing market.

The information contained herein is for informational and educational purposes only and is not an offer to sell or a solicitation of any offer to buy any securities. The information contained herein is not intended to and does not constitute investment, legal, or tax advice, or recommendation of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Any investment in securities involves a high degree of risk and may not be suitable for all investors and you should consult with an expert before making investment decisions. The views or opinions expressed herein represent those of Ignite Investments, LLC (“Ignite”) or its affiliated sponsors at the time of publication. No assurance can be provided that any of the future events referenced herein (including but not limited to projected or estimated returns or performance results) will occur on the terms contemplated herein or at all. While the data contained herein has been prepared from information that Ignite believes to be reliable, Ignite does not warrant the accuracy or completeness of such information. Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve. Please see Terms & Conditions for full disclosures.

Investments in commercial real estate (CRE) involve significant risks, including market risks, interest rate risks, and liquidity risks, and may not be suitable for all investors.

Securities transactions conducted through Umergence, LLC. Member: FINRA/SIPC. Umergence is not affiliated with any entities identified in this communication.

© 2024 IGNITE INVESTMENTS, LLC